Before diving into the different types of payment methods, it’s crucial to understand the fundamental components of payment processing. Two vital elements are a merchant account and payment processing hardware. These tools allow you to accept and process payments securely and efficiently. With the right setup, your business can become a formidable contender in today’s competitive market.

To stay competitive and meet customer expectations, your business needs a robust system to accept various payment methods. Whether it’s traditional options like cash and checks or modern digital transactions, the payment landscape is continually expanding. Here’s what you’ll need:

- Apply for a Merchant Account

A merchant account is essential for accepting payments. Typically set up through a payment processor or acquiring bank, this account acts as an intermediary between your business and the payment processor, ensuring secure transactions. SignaPay provides merchant accounts that comply with industry standards like the Payment Card Industry Data Security Standard (PCI DSS), safeguarding your customers’ financial information.

- Utilize Payment Processing Hardware

Payment processing hardware is crucial for facilitating smooth and secure transactions. A point-of-sale (POS) system forms the backbone of in-person payments, incorporating devices like cash registers, card readers, and receipt printers. SignaPay offers state-of-the-art POS systems and card readers compatible with chip-enabled and contactless payments, ensuring your business is equipped to handle any transaction.

The 10 Most Common Payment Methods

The payment landscape offers various methods, each with its level of convenience and security. As a business, adopting multiple payment options can help meet your customers’ needs. Here are the ten most commonly accepted types:

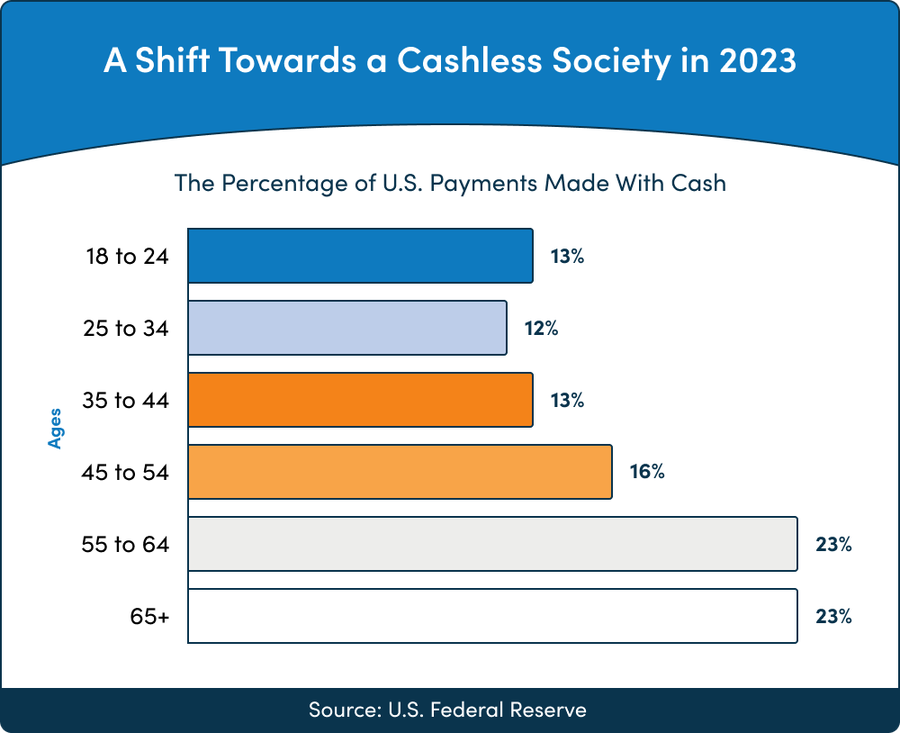

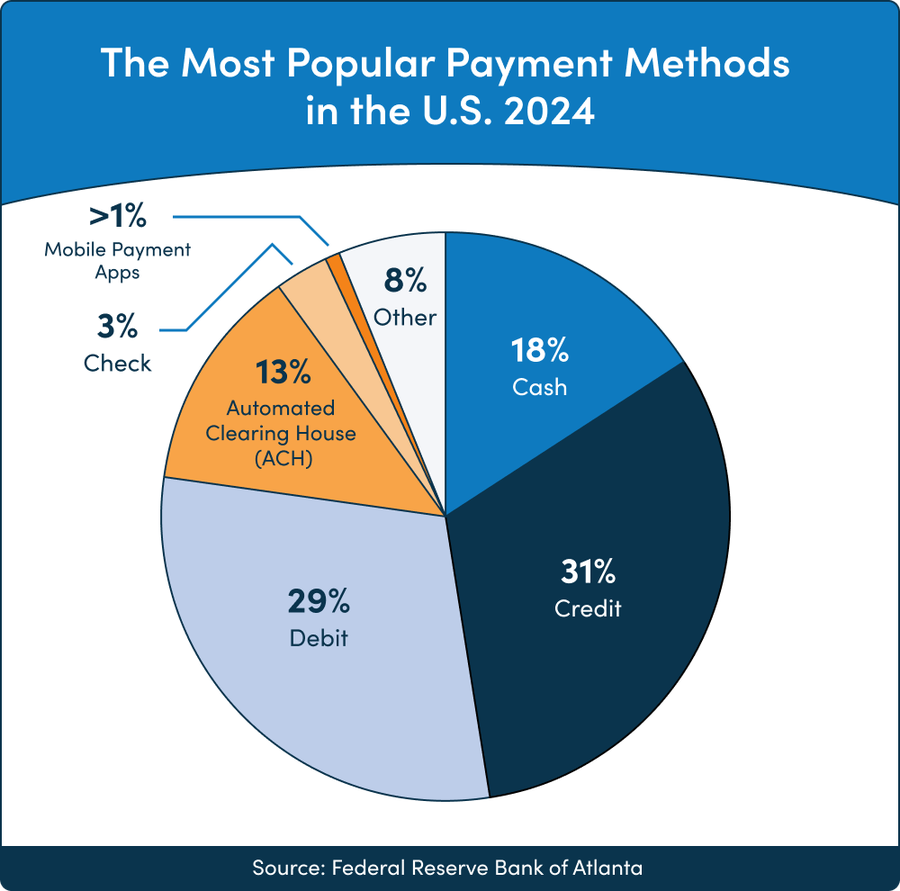

- Cash

Cash is still popular for its immediacy and tangibility. It’s widely accepted, especially in areas with limited banking infrastructure, making it a reliable payment method globally.

- Debit Cards

Debit cards offer immediate access to funds and are widely accepted both online and in-person. They’re a great option for customers who prefer to avoid debt.

- Credit Cards

Credit cards provide flexibility for customers, allowing them to manage their finances effectively and even earn rewards. SignaPay’s payment processing solutions ensure that credit card transactions are secure and efficient.

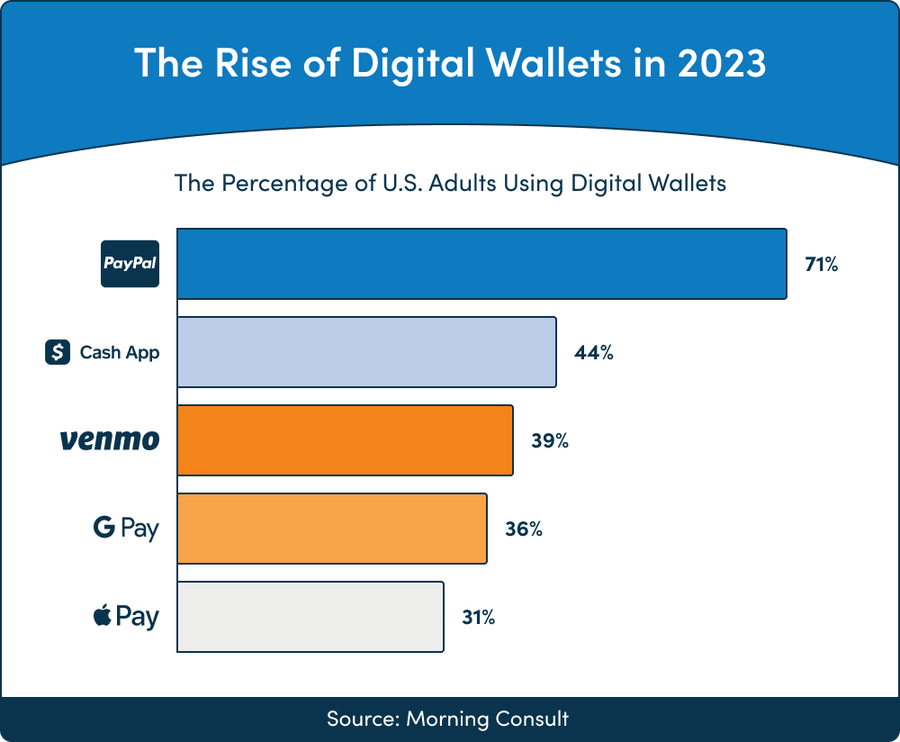

- Mobile Wallets

Mobile wallets like Apple Pay and Google Pay offer convenience by storing payment information digitally. SignaPay’s NFC-enabled devices make it easy for you to accept mobile wallet payments.

- ACH Transfers

ACH transfers offer a quick, secure, and cost-effective way to transfer funds electronically between bank accounts. They’re ideal for businesses dealing with recurring payments.

- Paper Checks and eChecks

While traditional, paper checks are still in use, providing a physical record of transactions. eChecks, on the other hand, offer the convenience of electronic transactions with faster processing times.

- Bank Transfers

Bank transfers involve the direct electronic transfer of funds between bank accounts, offering high security and lower transaction fees.

- Contactless Payments

Contactless payments have surged in popularity due to their speed and security. Customers can complete transactions by simply tapping their card or device on a contactless terminal.

- Online Payment Gateways

Online payment gateways act as secure intermediaries for electronic transactions, providing a seamless checkout experience on eCommerce platforms. SignaPay integrates with various online payment gateways to streamline your customers’ online purchasing experience.

- Payment Apps

Payment apps offer convenience and added features like transaction tracking and rewards programs. SignaPay supports these apps, ensuring you can cater to your tech-savvy customers.