Understanding PCI Compliance: Safeguarding Your Business

In today’s digital age, where transactions are increasingly conducted online and through credit cards, ensuring the security of sensitive payment information is paramount. This is where PCI compliance plays a crucial role. PCI compliance, or Payment Card Industry Data Security Standard compliance, is not just a regulatory requirement but a fundamental practice for businesses aiming to protect their customers’ data and uphold their trust. Let’s delve into what PCI compliance entails, its impact on business operations, and the benefits of adhering to these standards.

What is PCI Compliance?

PCI compliance refers to a set of security standards established by major credit card companies to protect cardholder data during and after a financial transaction. These standards are designed to prevent data breaches and maintain secure payment environments across all channels—online, in-store, and mobile. Compliance involves adhering to specific requirements that dictate how businesses handle, store, and process credit card information securely.

Key Requirements of PCI Compliance

Achieving PCI compliance involves meeting several core requirements:

- Building and Maintaining a Secure Network: Implementing robust firewall configurations to protect cardholder data.

- Protecting Cardholder Data: Encrypting transmission of cardholder data across open, public networks to ensure its safety.

- Maintaining a Vulnerability Management Program: Implementing and regularly updating anti-virus software and secure systems and applications.

- Implementing Strong Access Control Measures: Restricting access to cardholder data on a need-to-know basis and assigning a unique ID to each person with computer access

- Regularly Monitoring and Testing Networks: Tracking and monitoring all access to network resources and cardholder data to identify and respond to security vulnerabilities.

Impact on Data Security

The primary objective of PCI compliance is to enhance data security. By adhering to these standards, businesses significantly reduce the risk of data breaches and protect sensitive customer information. This proactive approach not only safeguards the financial health of the business but also preserves its reputation in the marketplace.

Operational Changes and Challenges

Implementing PCI compliance may necessitate operational adjustments such as upgrading payment systems, conducting employee training on security protocols, and maintaining continuous security monitoring. While these changes require investments in time and resources, they are essential for ensuring ongoing compliance and protecting against evolving cyber threats.

Financial Implications

While achieving PCI compliance involves initial and ongoing costs—such as technology upgrades, training, and audits—the financial consequences of non-compliance can be far greater. Fines from regulatory bodies, increased transaction fees, and potential loss of business due to reputational damage are significant risks associated with non-compliance.

Building Customer Trust and Reputation

Adhering to PCI compliance standards is instrumental in building and maintaining customer trust. Consumers are increasingly aware of data security risks and are more likely to patronize businesses that prioritize protecting their personal and financial information. A reputation for strong data security practices can differentiate businesses in a competitive marketplace and foster long-term customer loyalty.

Legal and Regulatory Benefits

Meeting PCI compliance requirements not only ensures alignment with industry standards but also facilitates compliance with other regulatory requirements. This integrated approach helps businesses navigate complex legal landscapes more effectively and mitigates the risk of legal repercussions related to data breaches.

Long-Term Benefits

While achieving and maintaining PCI compliance requires dedication and resources, the long-term benefits are substantial. These include enhanced data security, reduced risk of data breaches, improved operational efficiency, strengthened customer relationships, and a competitive edge in the marketplace. Businesses that prioritize PCI compliance are better equipped to adapt to evolving security challenges and regulatory changes, positioning themselves for sustained growth and success.

Simply Save Money

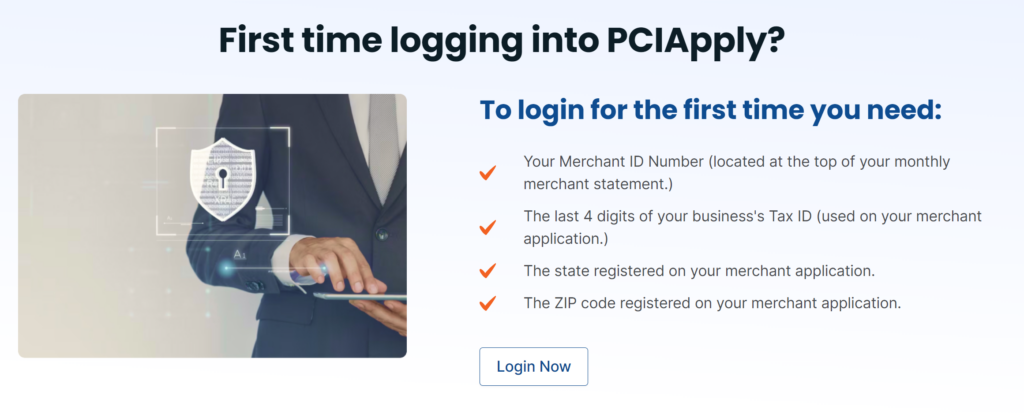

Just by going through the PCI Compliance process can save you around $40/month in PCI non-compliance fees. Contact your merchant service provider on their preferred process. SignaPay Merchants can become PCI compliant quickly and easily using PCIApply.

Our Commitment at SignaPay

At SignaPay, we recognize the critical importance of PCI compliance for your business. Our comprehensive solutions are designed to ensure that your operations meet and exceed PCI security standards. Trust us to safeguard your business, protect your customers’ sensitive information, and uphold the highest standards of data security. Together, we can navigate the complexities of PCI compliance and secure a prosperous future for your business.

For more information on how we can support your PCI compliance efforts, visit us at signapay.com/pci. Protect your business, build customer trust, and stay ahead of regulatory requirements with SignaPay.

Recent blog posts

The latest industry news, interviews, technologies, and resources

SignaPay Celebrates Fourth Appearance on Inc. Magazine’s Inc. 5000 List

FOR IMMEDIATE RELEASE Dallas, TX, August 13, 2024 – SignaPay, a premier provider of innovative payment solutions, is thrilled to announce its inclusion in Inc. Magazine’s prestigious Inc. 5000 list …

Closing B2B Merchant Sales: A Guide for Success

Closing merchant service sales takes more than a great pitch—it requires strategy, persistence, and a value-driven approach. Business owners need trusted payment partners who offer transparent pricing, reliable technology, and strong support. To succeed, sales reps must understand their prospects’ needs, lead with value, build trust, and confidently address objections. Using social proof, creating urgency, and following up effectively can turn hesitant prospects into long-term customers. By refining your approach and positioning SignaPay’s solutions as the best choice, you can close more deals and grow your portfolio. Ready to level up your sales game? Let’s get started!

The Secret to Passive Income and Career Growth: Becoming an ISO Partner

As the payment processing landscape evolves, Independent Sales Organizations (ISOs) have become pivotal in bridging the gap between merchants and financial institutions. For entrepreneurs and professionals in the payment industry, …

Navigating the Quantum Highway: From Morning Commutes to Payment Security at SignaPay

By: David Leppek, CTO SignaPay January 7th, 2025 As I navigate the intricate highways of Dallas, my GPS guides me effortlessly to SignaPay’s office in Irving, Texas. Recently appointed as …